Time Value of Money

I’m quite sure most of you have heard the clichés like these:

“$100 you receive today is not the same value as $100 you receive 5 years later”

“If you are paying out the same amount, it’s better you pay later”

But……do you actually know what they really mean…?

These quotes are not a philosophy nor a proverb. They are not even a simplification of some super sophisticated financial mechanism that takes place inside of a black box. Instead, they are facts. And, yes, this section is all about me trying to explain it to you.

Before we move on, however, please remember the assumption I mentioned earlier: whenever you receive cash, you are depositing it in a bank immediately to enjoy compound interest. Here we go.

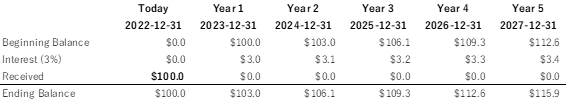

Let’s imagine that you receive $100 today, December 31st, 2022. What you do, according to the assumption, is that you deposit that $100 in a bank. And that bank offers, say, 3% interest on any deposit. What happens from that day is that the bank will look at the beginning balance at each 1st day of each year, calculate the interest with 3%, and pay you the interest. So here, on January 1st, 2023, the bank will see $100 as your beginning balance and pays you $3 interest ($100 x 3%).

Now, based on the assumption (remember? “Any cash you receive is redeposited”), you are redepositing that $3 interest that you just received. Hence, on January 1st, 2024, the bank will now see $103 as your beginning balance, instead of $100. Then, in 2024, the bank will pay you $3.1 interest, more interest than what you got in 2023 because the beginning balance of 2024 is now larger due to the interest you received and redeposited during 2023. By, again, redepositing that $3.1 to your account, the beginning balance in 2025 will now be $106.1, from which you earn, this time, $3.2 interest. With the same token, your balance and yearly interest will grow larger and larger, which results in your final balance at Year 5 of $115.9.

So here’s a table of what’s going on.

As you can see, because of the compound interest at 3%, your $100 received today (December 31st, 2022) has become $116 5 years later (December 31st, 2027).

Here, I’ve used a table to explain the effect of the compound interest step by step, but you can also use a formula below to calculate how much certain amount can be through certain duration of time, which is called “compound interest formula”:

So, if you deposit $100 in a bank with 3% interest and keep it for 5 years, the amount you will have in your account in Year 5 will be as follows:

I usually don’t say this, but…I want you to remember this compound interest formula because it will reappear in the later sections, especially when you learn about the present value.

Now. This time, I want you to imagine that you are going to receive $100 5 years later, December 31st, 2027, instead of today. Because you are not going to have any cash in your account until then, there will not be any privilege to earn the compound interest. (no cash, no beginning balance, no interest. You see?) Hence, the final balance at December 31st, 2027 is…yes, $100.

Let me clarify it. In the earlier case, if you receive $100 today, the final balance becomes $115.9 in 5 years. But this time, even if you receive the same amount of $100, the final balance remained at $100 just because you received it later. And this is what the people are referring to as “$100 is not the same VALUE as the same $100 in year 5” because, the later you receive, the more you are forgoing (missing) opportunity to enjoy compound interests. Do you get the idea?

Without a doubt, the same idea is applied to a case where you receive $20 annually for the next 5 years. Although the total amount you receive will be the same $100 ($20 x 5 times), the value will be different from the earlier cases where you received $100 today. Why? Again, because of “when” you receive cash is different, hence forgoing a chance to enjoy the compound interest.

See? If you received $100 today, you ended up with $115.9. If you received $100 on Year 5, you ended up with $100. Whereas this time, you ended up with $106.2.

This tells you that in the latest case, you are not enjoying the maximum benefit of the compound interest because some portion of cash are received later. However, you are enjoying more benefit than the case where you receive $100 in Year 5. Hence, the final balance is between those two cases.

At this point, you might be wondering “alright, cases using $100 were rather simple. But, what if I have several options to receive different amounts of cash in different timings throughout different duration” or “what is there are payments required, not only cash receipts? How can I know which option is better?” Very good question.

For such more intricate cash flows with more ins and outs of cash flow, you have 2 options. You can either create similar tables like the ones we just looked at and compare the result, or you can thank those geniuses who have prepared some tools for you to evaluate different cash flows.

But, unfortunately, I’m not diving in there, yet. In order for you to understand how those tools are used and how to interpret the results, you need to remember another concept called Present Value.